Bankruptcy Statistics

Home > Bankruptcy >

Bankruptcy is a scary notion to many, but for those caught in challenging financial situations that involve heavy debt, bankruptcy can also be a viable option to gain a new start.

Bankruptcy is often caused by financial hardship. Those filing simply can’t afford to deal with unexpected major expenses, such as medical bills. Or they may have experienced a decline in income or a job loss.

Peaks in bankruptcy petitions typically signify economic downturn, and states with fewer consumer-friendly laws typically have a higher rate of filings. Consumers could consider debt consolidation options – debt management plans, debt consolidation loans and debt settlement – as alternatives to avoid filing for bankruptcy.

Number of Bankruptcy Filings

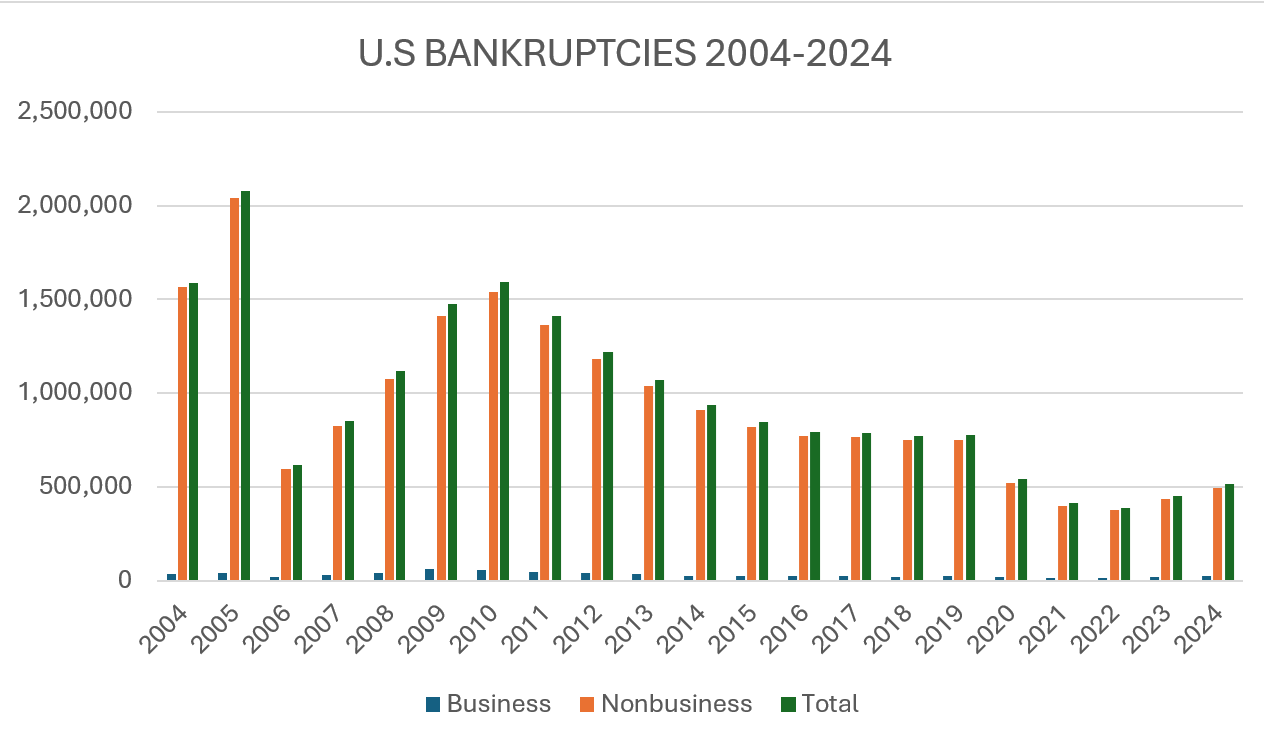

Bankruptcy filings dropped during the pandemic as federal aid helped people pay their bills. But since then, bankruptcy filings have been steadily on the rise.

There were 517,308 bankruptcy cases filed in 2024, both individual and business, according to U.S. Bankruptcy Courts statistics. That’s a 14.2% increase from the 452,990 filed in 2023. In 2022, 387,721 bankruptcies were filed in the U.S. The overall numbers are well below pre-pandemic numbers, but the steady increase does reflect the evolving economy.

“The growing number of households and businesses filing for bankruptcy reflects the mounting economic challenges they now face,” said Amy Quackenboss, executive director of the American Bankruptcy Institute. “Debt loads are expanding as the prices of goods and services have gone up with inflation and the cost of borrowing continues to rise. While pandemic relief efforts have largely expired, the safe haven of bankruptcy is continually available for financially distressed businesses and consumers.”

Bankruptcy filings hit an all-time high in 2005, with more than two million cases. That year, one out of every 55 households filed for bankruptcy. The following year, bankruptcy filings dipped to about 600,000, the lowest point in 20 years at the time. The reduction came after the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) was enacted. It made major changes to the bankruptcy code, including introducing the means test for Chapter 7 filings. Even when the Great Recession spurred an increase in bankruptcies beginning the next year, they didn’t come close to the 2005 peak.

The last five years have shown the impact of the pandemic and how relief aid helped, as well as a temporary change to eligibility and debt limits. In 2019, the year before COVID, there were 774,940 filings. That’s just less than the sum of all filings for 2021 and 2022 combined. In 2020, filings dropped 30%.

Source: U.S. Courts

Business and Nonbusiness Bankruptcy Filings

Bankruptcy filings can be personal or business-related. Personal filings happen when an individual cannot pay their bills and is swamped with debt. Business filings happen when a business is in a financial bind, be it a large retail outlet or a mom-and-pop shop.

The vast majority of bankruptcies are filed by consumers and not by businesses. In 1980, businesses accounted for 13% of bankruptcies. In 2024, they accounted for 4.4%.

Here’s a look at the number of business vs. personal bankruptcies over the past seven years.

| Business | Non-business | Total | |

|---|---|---|---|

| 2024 | 23,107 | 494,201 | 517.308 |

| 2023 | 18,926 | 434,064 | 452,990 |

| 2022 | 13,481 | 374,240 | 387,721 |

| 2021 | 14,347 | 399,269 | 413,616 |

| 2020 | 21,655 | 522,808 | 544,463 |

| 2019 | 22,780 | 752,160 | 774,940 |

| 2018 | 22,232 | 751,186 | 773,418 |

Source: U.S. Courts

Bankruptcy Filings by Chapter

Filing bankruptcy means choosing which chapter applies to your situation. Most personal bankruptcies are Chapter 7 or Chapter 13; most businesses file Chapter 7 or Chapter 11, but all three can be used either way, depending on the financial circumstances of the person or business.

In Chapter 7, nonessential assets are sold (in most cases, this does not include your house) and the money raised is used to discharge debts. In the case of a business, all of its assets are sold and the business closes. A small business is more likely to file Chapter 7 than Chapter 11.

In Chapter 13, a 3-5-year payment plan to pay down debt is agreed to with the court. Any unsecured debt left once the plan is completed is discharged.

Chapter 11 allows a business to continue operating as its creditors are paid and it is reorganized. It’s generally used by large businesses and corporations that have the assets that allow it to continue to operate while the reorganization is going on. It’s sometimes used by individuals whose debt is too high for Chapter 13 (think pro athletes and movie stars).

The goal of any bankruptcy is to have debts discharged, which gives you a new start to right your financial ship.

Here is a look at the number of bankruptcies by most common chapters in the past seven years:

| YEAR | Chapter 7 | Chapter 11 | Chapter 13 |

|---|---|---|---|

| 2024 | 310,631 298,049 personal 12,582 business | 8,884 428 personal 8,456 business | 197,244 195,724 personal 1,520 business |

| 2023 | 261,277 251,048 personal 10,229 business | 7,456 386 personal 7,070 business | 183,956 182,630 personal 1,326 business |

| 2022 | 225,455 217,727 personal 7,728 business | 4,918 453 personal 4,465 business | 157,087 156.060 personal 1,027 business |

| 2021 | 288,327 279,649 personal 8,678 business | 4,836 470 personal 4,366 business | 120,002 119,150 personal 852 business |

| 2020 | 378,953 367,034 personal 11,919 business | 8,333 547 personal 7786 business | 156,377 155,227 personal 1,150 business |

| 2019 | 480,206 465,991 personal 14,215 business | 7,020 968 personal 6,052 business | 286,979 285,201 personal 1,778 business |

| 2018 | 475,575 461,897 personal 13,678 business | 7,095 1,017 personal 6,078 business | 290,146 288,272 personal 1,874 business |

Source: U.S. Courts

» Learn More: Types of Bankruptcies

States with High Numbers of Bankruptcies

The number of annual bankruptcies varies widely by state and is a function of state population and policies. Every state has its own bankruptcy laws, and that can determine whether it has a high rate of filings or not.

The state with the most bankruptcy filings in 2024 was California, with 47, 621. But, to put it in perspective, California also has an estimated population of 39.4 million, so that’s roughly 119 bankruptcy filings per 100,000 residents. Compare that to Georgia, with the fourth highest number of bankruptcy filings 2024, 28,383. With a population of 3.8 million, that’s about 763 bankruptcies per 100,000 residents in 2024. Georgia’s generous bankruptcy laws, as well as weak consumer laws that lead to “debt traps,” are some of the major reasons for the high numbers, that state’s economy experts say.

At the other end of the spectrum, Alaska had the fewest filings in 2024, with 211. With a population of a little more than 740,000, the state had about 28 bankruptcies per 100,000 residents. Vermont was second lowest with 262. With a population of a little more than 648,000, the state had about 40 bankruptcy filings per 100,000 residents.

The five states with the most bankruptcy petitions in 2024 accounted for 33% of the 517,308 filings in 2024.

The five states with the highest number of bankruptcies in 2024 were:

- California: 47,621

- Florida: 37,156

- Texas: 31,520

- Georgia: 28,383

- Illinois: 25,997

Causes of Bankruptcy

Many factors go into why someone files for bankruptcy. It’s often a perfect storm of issues that tips someone over the edge. Medical bills and loss of job or income are consistently the top reasons people give for why they file for bankruptcy. In a survey by the Consumer Bankruptcy Project, 78% cited a decline in income as a reason for their bankruptcy, and 65% cited medical issues, both the cost of the bills, as well as missing work because of medical issues. The Kaiser Family Foundation found that 41% of U.S. residents have some sort of medical debt, including on credit cards or owed to a family member; 24% were considering bankruptcy to solve a medical debt issue.

Unsecured debt, like credit cards and student loans also are contributors. Life changes can also disrupt a tight budget, like divorce or having to care for a family member, which can both add to expenses and have an impact on income.

Changing Demographics of Bankruptcy Filers

No government agency keeps consistent statistics about the demographics of bankruptcy filers, but in studies over the decades, many trends remain consistent: people who file for personal bankruptcy are more likely to not have a college degree, be middle class, be female, single, and middle-aged or older.

Age at Bankruptcy

Since the early 1990s, bankruptcy has been used with increasing frequency by older individuals. The median age of those filing for bankruptcy is 49, the Consumer Bankruptcy Project found. [Median means half are older, have younger]. In the last 20 years, the number of people 65 and older filing for bankruptcy has increased to become its fastest-growing demographic group, the CBP found. The age group has increased from 4.5% of bankruptcy filers in 2001 to 18.7% by 2022. This is partially because the number of people 65 and older in the U.S. increased 38.6% between 2010 and 2020, more than twice the 15.1% rate of the decade before.

Repeat Filers

In 2023, 35% of 179,936 Chapter 13 filers reported that they’d filed a bankruptcy petition during the previous eight years. New York’s eastern district recorded the highest percentage of repeat filers, 54%, followed by Utah at 52%. The lowest number of repeat filers filing Chapter 13 were in North Dakota, 13%, and Puerto Rico, 16%.

The U.S. Bankruptcy Court doesn’t provide statistics on how many people filing Chapter 7 are repeat filers, but a recent study found that as many as 46% of those filing for bankruptcy may have filed some time in the previous 30 years.

There is no limit to how many times a person can file for bankruptcy, but there are required waiting periods between filing. How much time you have to wait after a bankruptcy to file again depends on the type of bankruptcy and what happened with it:

- Chapter 13 discharge: 2 years to file Chapter 13; 6 to file Chapter 7

- Chapter 7 discharge: 4 years to file Chapter 13; 8 to file Chapter 7

- Chapter 13 dismissal: Immediate for new Chapter 13

- Chapter 7 dismissal: 180 days to file Chapter 7 or Chapter 13, in most cases, depending on reason for dismissal.

Gender and Marital Status

Single women make up about 33% of those filing for bankruptcy; they’ve been the largest demographic for the past two decades, according to CBP. The number includes widows, women who have never married, and divorced women. About 15% of filers are single men. The remaining number of those who file are married or partnered. Single women are more likely than single men to be responsible for dependents, usually children, than the men who file, and most of them file a Chapter 7 petition.

Education Level

People filing for bankruptcy, on average, are high school graduates, have some college education but are less likely to have a degree than the general population.

About 25% of those who file for bankruptcy have student loan debt. It’s an added burden former students, as many as 40%, who weren’t able to graduate and reap the financial benefits of a degree but still have to pay the debt. In 2022, the federal government provided new guidance that makes it easier for student loan debt to be discharged. The U.S. Department of Justice reported in 2024 that 98% of cases filed that qualified had been successful since the new rules were put in place.

Income Level

Median gross household income for bankruptcy filers in 2019 was $35,000-$70,000, according to the CBP. The study points out that’s below the national median, but above the poverty line. The biggest issue people who file for bankruptcy have is debt, not income, they found. Bankruptcy filers tend to be overburdened with credit cards, auto loans, mortgages, student loans, payday loans, medical and other debt.

Those filing for bankruptcy who have a four-year college degree make an average 62% of what the general population with the same education level earn.

About 50% of households are entering bankruptcy on the heels of a legal action, including foreclosure, vehicle repossession, or wage and bank account garnishment, according to CBP. Some 77% of filers cite debt collection as a contributor to their bankruptcy.

No one is immune to severe financial troubles. If you find yourself struggling financially, consider debt settlement and debt consolidation before turning to bankruptcy.

Talk to a Credit Counselor Before Filing for Bankruptcy

All individuals who are considering filing for bankruptcy are required to speak to a credit counselor before they file. The purpose is to determine whether there is a better option than filing for bankruptcy.

A discussion with a counselor at a nonprofit credit counseling agency is usually free of charge and can be done with a phone call. The counselor will review your budget and finances with you, and discuss options for debt relief.

Debt relief options besides bankruptcy that the credit counseling will cover include debt management plans, which are good solutions for people with a lot of credit card debt. The counselor works with credit card agencies to lower interest rates, and you make a single monthly payment to the agency, while it pays down your credit cards.

The most important bankruptcy statistic is the number 1. That’s you. If you are overwhelmed with debt, be sure you consider all debt relief options and determine what’s best for you.

Sources:

- N.A. (2024, December 31) Bankruptcy Filing Statistics. Retrieved from https://www.uscourts.gov/data-news/reports/statistical-reports/bankruptcy-filings-statistics

- N.A. (2025, February 4) Bankruptcy Filings Rise by 14.2%. Retrieved from https://www.uscourts.gov/data-news/judiciary-news/2025/02/04/bankruptcy-filings-rise-14-2-percent

- Mariano, W. (2019, November 26) Debt traps, easy filing rules fuel Georgia’s high bankruptcy rate. Retrieved from https://georgiawatch.org/debt-traps-easy-filing-rules-fuel-georgias-high-bankruptcy-rate/

- Foohey, P. et al (2024, May 9) Debt on the Ground: The Scholarly Discourse of Bankruptcy and Financial Precarity. Retrieved from https://www.annualreviews.org/content/journals/10.1146/annurev-lawsocsci-042022-112004

- Rakshit, S. (2024, February 12) The burden of medical debt in the United States. Retrieved from https://www.healthsystemtracker.org/brief/the-burden-of-medical-debt-in-the-united-states/

- Caplan, Zoe. (2023, May 25) U.S. Older Population Grew from 2010 to 2020 at Fastest Rate Since 1880 to 1890. Retrieved from https://www.census.gov/library/stories/2023/05/2020-census-united-states-older-population-grew.html

- NA, (ND). Chapter 7 – Bankruptcy Basics. Retrieved from https://www.uscourts.gov/court-programs/bankruptcy/bankruptcy-basics/chapter-7-bankruptcy-basics

- NA (ND) Chapter 13 – Bankruptcy Basics. Retrieved from https://www.uscourts.gov/court-programs/bankruptcy/bankruptcy-basics/chapter-13-bankruptcy-basics

- NA (2023, December 31) BAPCPA Report 2023. Retrieved from https://www.uscourts.gov/data-news/reports/statistical-reports/bankruptcy-abuse-prevention-and-consumer-protection-act-report/bapcpa-report-2023

- Pang, Belisa, (2024, January 31). The Bankruptcy Revolving Door. Retrieved from https://ssrn.com/abstract=4911339

- N.A. (2024, July 17) Justice Department and Department of Education Announce Continuing Success of Student-Loan Bankruptcy Discharge Process. Retrieved from https://www.justice.gov/archives/opa/pr/justice-department-and-department-education-announce-continuing-success-student-loan