Staff Writer

Bill Fay

Bill “No Pay” Fay has lived a meager financial existence his entire life. He started writing/bragging about it in 2012, helping birth Debt.org into existence as the site’s original “Frugal Man.” Prior to that, he spent more than 30 years covering the high finance world of college and professional sports for major publications, including the Associated Press, New York Times and Sports Illustrated. His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet.

Anyone new to bankruptcy can’t be blamed for thinking the whole process equals doom, gloom, and forfeiture. After all, filing bankruptcy is not going to look good on your resumé…

Credit card debt has skyrocketed to more than $1.1 trillion. So has looking for ways to avoid paying interest on that mountain of money. For millions of Americans, the search…

Borrowers who’ve gotten themselves tangled in a charge-off situation face difficult choices. Pay the debt in full? Try to settle for a lesser amount? Run away and hide? “The world…

For those seeking a fresh financial start, Chapter 7 bankruptcy has plenty of upsides. It’s the cleanest, most straightforward, least time-consuming, and least expensive of the various bankruptcy options. The…

When people get married, they often vow to take each other through thick and thin. Bankruptcy can get pretty thick for a husband and wife. Bankruptcy is when a person…

Growing older never was for the fainthearted, but it takes exceptional courage to navigate those Golden Years with dents on your credit report and a need for cash. Chins up,…

Choosing to declare personal bankruptcy can be among the most difficult decisions ever to confront an individual. Tougher still: Having to pick, under unmatched duress, which type of bankruptcy best…

There are plenty of reasons to consider making car loan payments with a credit card — everything from piling up rewards points or cash back, to scoring a bit of…

With President Biden declaring an end to pandemic emergency provisions effective May 11, and states and companies already having rescinded most of their debt collections suspensions, debt collectors are totally…

A bankruptcy discharge is the legal holy grail for anyone who files for bankruptcy. A discharge means there’s a court order in the bankrupt’s case that erases all qualifying debts.…

Debt Relief Programs in South Carolina Those who are struggling to pay off debt in South Carolina can find programs to help through banks, credit unions, online lenders, and for-profit…

Debt Relief Programs in Missouri Missouri residents struggling to pay off debt can find assistance programs at banks, credit unions, online lenders, and for-profit and nonprofit debt relief companies. These…

If you have so much debt that you’re considering filing a Chapter 7 bankruptcy, you have enough debt to qualify. The U.S. bankruptcy code doesn’t specify a minimum dollar amount…

Debt Relief Programs in Minnesota There are banks, credit unions, online lenders, and debt-relief companies (for-profit and nonprofit) in Minnesota that specializes in helping consumers pay off credit card debt. These companies…

A rare silver lining to the Covid pandemic was Americans managed to pay down billions of dollars in credit card debt. Those days have screeched to a halt. Credit card…

Debt Relief Programs in Indiana There are banks, credit unions, online lenders and debt-relief companies (for profit and nonprofit) in Indiana that specialize in helping consumers pay off credit card debt.…

Debt Relief Programs in Wisconsin Wisconsin residents struggling to pay off debt can find assistance programs at banks, credit unions, online lenders, and for profit and nonprofit debt relief companies.…

Debt Relief Programs in Washington There are a number of resources available for residents of the Evergreen State who find themselves in financial peril. Banks, credit unions, online lenders, for…

Debt Relief Programs in Tennessee Tennessee has a number of companies that specialize in helping consumers pay off credit card debt including banks, credit unions, online lenders, and both for…

Debt Relief Programs in Colorado Colorado has a number of companies that specialize in helping consumers pay off credit card debt including banks, credit unions, online lenders, and both for…

Admission procedures may run a little differently at your local hospital beginning this week. October 1 marked the launch of a key provision of the ObamaCare law that could create…

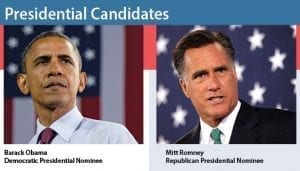

When Republican presidential candidate Mitt Romney and President Barack Obama square off in Colorado on Wednesday during the first presidential debate, Americans will be waiting for an answer to a…

A member of the middle class in America can make as little as $30,000 or as much as $100,000, depending on whom you believe, but one defining characteristic isn’t so…

Since the Great Depression, Democrats and Republicans have defined themselves as the new version of Santa Claus. Saint Nick brings wonderful things to children for free. There’s no cost. When…

More and more older Americans are reaching retirement age without enough money to survive in the way they would prefer, according to multiple surveys and studies. Is there anything Congress can do? Or, rather, is there any Congress will do?

Just when economists were prepared to report on the dismal state of the American real estate market for another quarter, new statistics revealed a much brighter account. Existing home sales…

More than three dozen Republican U.S. Senators voted against the $1 billion Veterans Job Corps Act of 2012 – a fully paid-for, bipartisan piece of legislation that would have put thousands of veterans back to work tending to the country’s federal lands and bolstering local police and fire departments.

Banking used to be simple. Bankers lived by the 3-6-3 rule — borrow at 3 percent, loan at 6 percent, and hit the golf course by 3 in the afternoon.…

A new federal agency aimed at enforcing consumer finance laws tangled with its second high-profile target since opening its doors less than two years ago. The Consumer Financial Protection…

Freshly graduated college students are finding little success in the job market. Low starting salaries and the need to repay student loans is pushing many of them to go back to school.

As Americans diligently work to recuperate from the worst economic recession since the Great Depression, recent reports show the road to recovery may prove to be very long. The Great…

The Credit CARD Act of 2009 was supposed to help borrowers who do not work outside the home, but one interpretation is cutting the access those potential borrowers have to credit. One lawmaker describes this as a return to the “dark days” of lending when women were disenfranchised.

The Federal Housing Administration (FHA) recently developed a program to help homeowners facing possible foreclosure and to prevent an excess of defaulted mortgages and home loans. The new program, known…

Taxpayer-owned mortgage lender Fannie Mae wasn’t happy with how Bank of America serviced its mortgage loans and decided to find another partner. But instead of taking the loans back — as it could have under the agreement — Fannie Mae instead paid BOA millions for the right.

American seniors are fighting an ongoing battle as they try to cope with medical expenses on top of an already high cost of living. A recently published study has revealed…

As millions of Americans struggle to keep up with monthly expenses in a tough economy, consumers in search of automobile loans are in for some good news: not only have…

A relationship between debt collectors and district attorneys that allows for the use of D.A. letterhead in the collections process shouldn’t be considered sound policy. It’s just too cozy.

America’s seniors were once considered among the most financially secure, with retirement at the top of the agenda. By the time people reached their 50s and 60s, Social Security and…

As a record number of borrowers default on their student loans, a new poll shows that those who haven’t paid off their loans want their lenders to forgive the debt.…

“It’s the economy, stupid,” was the mantra of Bill Clinton’s successful 1992 presidential campaign. At a time when the country was recovering from two-and-a-half quarters of recession and with unemployment…