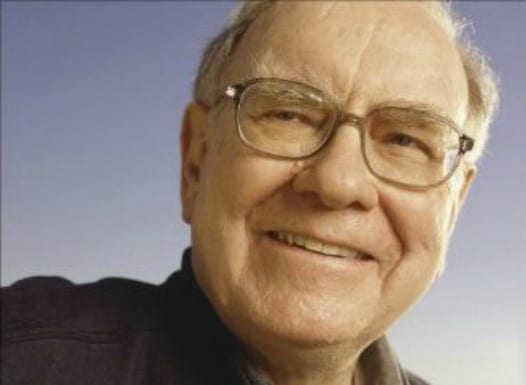

Billionaire Warren Buffett Rallies Support for Tax Hikes on the Rich

The new book about Warren Buffett is called “Tap Dancing To Work,” but what the billionaire investor is saying during promotional appearances this week feels much more like clogging than tap dancing.

Buffett stomped on fellow billionaires and the politicians who protect them, in an op-ed piece in The New York Times. The column called for a minimum tax on high-income earners and belittled politicians who want to put off talk of any changes in the tax laws until they can reform the entire tax code.

Buffett then went on television and radio to pile on the naysayers who claim that raising taxes on capital gains and ordinary income would prompt wealthy investors to bury their money under a mattress, instead of investing it in the economy.

“If I call you at midnight tonight and tell you I’ve got the greatest stock I’ve ever seen, you’re not going to ask me what the tax rate is,” Buffett told NBC’s Matt Lauer on the Today show. “You’re going to say ‘What’s the name of that stock?’”

Buffett Shares Thoughts on Congress, Obama, Economy

That is one of many salvos Buffett fired during promotional appearances for the book, which was written by Fortune magazine writer Carol J. Loomis. Here are a few more of his thoughts about Congress, the president and the economy:

- In the New York Times article, Buffett wrote: “We need Congress, right now, to enact a minimum tax on high incomes. I would suggest 30 percent of taxable income between $1 million and $10 million, and 35 percent on amounts above that. A plain and simple rule like that will block the efforts of lobbyists, lawyers and contribution-hungry legislators to keep the ultra-rich paying rates well below those incurred by people with income just a tiny fraction of ours.”

- On whether such a tax could happen: “I wouldn’t be surprised if it happens. There is a general feeling among the American public certainly and even among many in Congress that rich people like me are getting away with low tax rates and it’s time to make tax rates more progressive.”

- On his proposal, which would mean his tax rate would go from 14 percent to 35 percent: “In the last 10 years, my tax rate has averaged way less than when I was in my 30s and 40s and believe me, I’m making a lot more now.”.

- On his support for President Obama’s proposal to eliminate the Bush tax cuts for high-income taxpayers. (Buffett prefers a cutoff point somewhat above $250,000 — maybe $500,000 or so.) “He (President Obama) knew my view on it because they made a call on Friday to see if I was able to speak to the president.”

- On the fact that the Forbes 400, the wealthiest individuals in America, hit a new group record for wealth this year: $1.7 trillion. (That’s more than five times the $300 billion total in 1992.) “In recent years, my gang has been leaving the middle class in the dust.”

- On claims that a tax increase on capital gains will scare away investors: “Between 1951 and 1954, when the capital gains rate was 25 percent and marginal rates on dividends reached 91 percent in extreme cases, I sold securities and did pretty well. In the years from 1956 to 1969, the top marginal rate fell modestly, but was still a lofty 70 percent — and the tax rate on capital gains inched up to 27.5 percent. I was managing funds for investors then. Never did anyone mention taxes as a reason to forgo an investment opportunity that I offered.”

- On the future of newspapers. (Buffett bought more than 60 newspapers this year.) “I think newspapers in print form, in most of the cities and towns where they are present, will be here in 10 and 20 years. I think newspapers do a good job of serving a community where there is a lot of community interest.”

- On what he learned when the economy crashed in 2008-09: “I learned I can buy stocks a lot cheaper and I like that. If I buy five hamburgers today and I can buy them for less tomorrow, then I like it better tomorrow. I don’t worry about what I paid yesterday.”

Sources:

- La Roche, J. (November 28, 2012). Warren Buffett Isn’t Worried About The Fiscal Cliff http://www.businessinsider.com/warren-buffett-on-cnbc-2012-11#ixzz2DX9ldhH3

- Haughney, C. (November 28, 2012). Buffett Says He Remains Bullish On Newspapers, Despite Closing One. New York Times.