Category:

Credit

Interest rates and credit cards have a powerful — and potentially explosive — relationship in the U.S. economy. Interest rates are the economic fuel that makes credit card companies so…

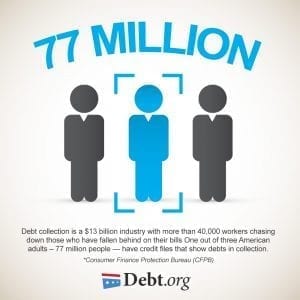

The debt collection industry generates $11 billion a year from the 70 million Americans who haven’t or can’t pay their bills. Debt collectors get most of their revenue from people…

There are a lot of tips and tricks on improving your credit score – and we’ll get to those in a moment – but nothing will raise your credit score…

The term “charge-off” means the business that gave you the loan, typically a card company or retailer, has written off the amount you owe as uncollectible, closed your account, and…

The calls came like clockwork, several times a week just as the Pinkuses were heading for bed. Each time, it was the same: a threatening voice with an even more…

It’s easy to get behind on paying the monthly bills. The economy may have slowed your ability to generate income, your investments may have dwindled, or perhaps you had an…

The era when almost anyone with a pulse could get a loan or mortgage from a commercial bank ended with the financial meltdown of 2008. Today, tightened regulations and a…

You’re in dire need of a vehicle but don’t have the cash to buy it outright. The thought of financing a car loan has your wheels spinning. There are many…

Debt consolidation lets borrowers combine multiple credit card debts into a new loan, a new credit card, or a debt management program. A loan calculator can help you determine if…

Few people sail through life without borrowing. Almost everyone needs a loan to buy a car, finance a home purchase, pay for a college education, or cover a medical emergency.…